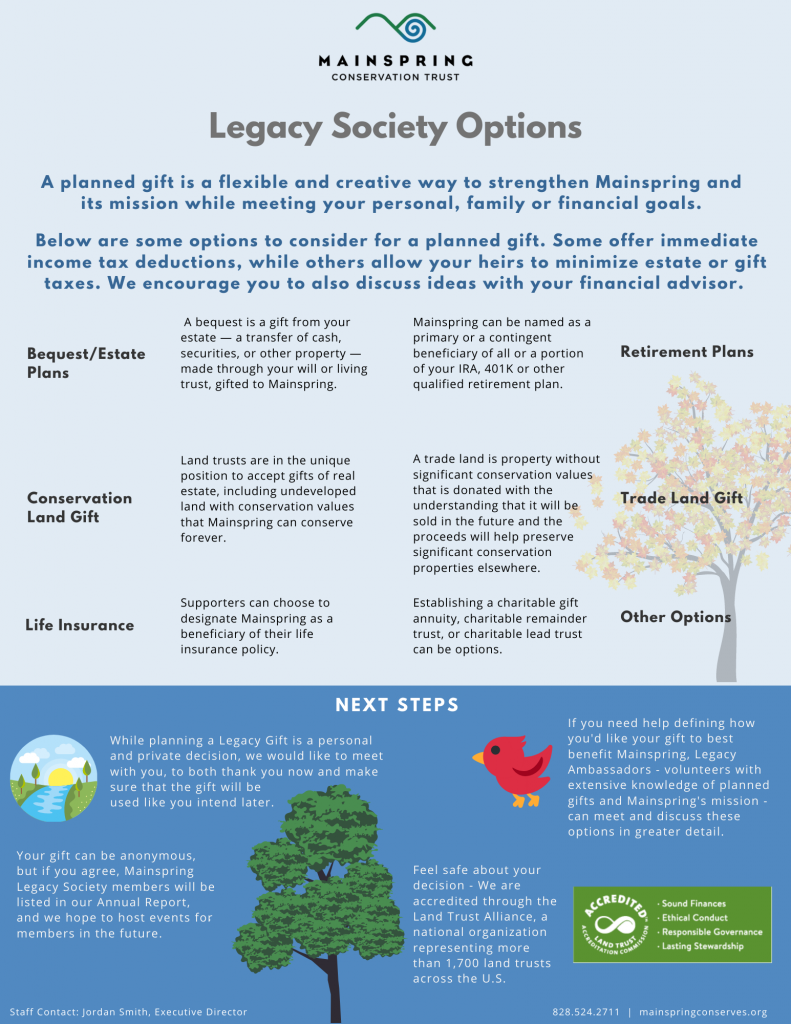

An gift in your will is a flexible and creative way to strengthen Mainspring and our mission while meeting your personal, family or financial goals.

There are a number of ways to support future conservation in the Southern Blue Ridge. Gifts to Mainspring from your estate are exempt from federal estate taxes, and some can offer immediate income tax deductions and/or allow your heirs to minimize estate or gift taxes. Some options include:

- Naming Mainspring as a primary or a contingent beneficiary of all or a portion of your IRA, 401K, or other qualified retirement plan.

- Aligning a gift of real estate, including personal residences or undeveloped land. Land trusts are in a unique position to accept gifts of real estate, either to permanently protect key conservation land or as a “trade land,” which is property without significant conservation values that is donated with the understanding that it will be sold in the future to help preserve noteworthy conservation properties elsewhere.

- Designating Mainspring as a beneficiary of your life insurance policy.

- Establishing a charitable gift annuity, and charitable remainder trust or a charitable lead trust.

Help us navigate the future with a gift in your will.

While planning a Legacy Gift to Mainspring is a personal and private decision, we would like to thank you now and make sure that your gift will be used as you intend. Notifying us of your intentions – at any level – places you in the Mainspring Legacy Society, a group of like-minded supporters who have included the organization in their estate plans. Legacy Society members will be listed in our Annual Report and we hope to host events to bring members together from time to time.

Want to know more? View, download and/or print this infographic PDF to help as you meet with your financial advisor to discuss ideas.

In addition to Jordan Smith, Executive Director, Mainspring Legacy Ambassadors – volunteers with extensive knowledge of planned gifts and Mainspring’s mission – can help discuss these options with you.

If you choose to talk directly to your estate attorney or financial advisor, Mainspring’s nonprofit tax ID number is 56-2142199.